Indian Ceramic Tile Exports 2023

The new MECS report analyses India’s ceramic tile exports between 2014 and 2023. It looks at volumes, values and average prices in the 139 export markets and features two new sections devoted to in-depth studies of porcelain tile exports and the global presence of India’s 30 top exporters.

Paola Giacomini

Over the past decade, India’s ceramic tile industry has come to global attention due to the meteoric growth of its export activity, which has increased steadily across all continents. Interestingly, this export growth is spearheaded not so much by the well-established Indian ceramic brands as by the dense network of companies located in the Morbi ceramic cluster in Gujarat.

Two figures give an idea of just how much India has come to dominate the world of international ceramic trade in recent years. In 2013, India exported just 55 million square metres of tiles and was the ninth largest exporter globally. By 2023, this figure had soared to 589.5 million sqm, with more than half of the total shipped outside Asia, positioning India as the second largest exporter worldwide. The moment when it overtakes China, originally projected by observers as early as 2023, has probably only been delayed given the narrow gap currently separating the world’s two largest exporters.

Given this rapid and seemingly unstoppable expansion, it is crucial to take a closer look at the scope and characteristics of India’s international market penetration.

A detailed picture is provided by the recently published report entitled Indian Ceramic Tile Exports 2023, produced by the MECS/Acimac Research Centre using data obtained from customs sources and trade databases. The report consists of 48 pages of tables and charts describing the variations between 2014 and 2023 in volumes, values and average prices of Indian exports to each of the 139 countries covered, along with two further in-depth studies, one devoted solely to porcelain tiles and the other to the top Indian exporters.

→ Find out more about Indian Ceramic Tile Exports 2023

India’s exports are expanding most rapidly outside Asia

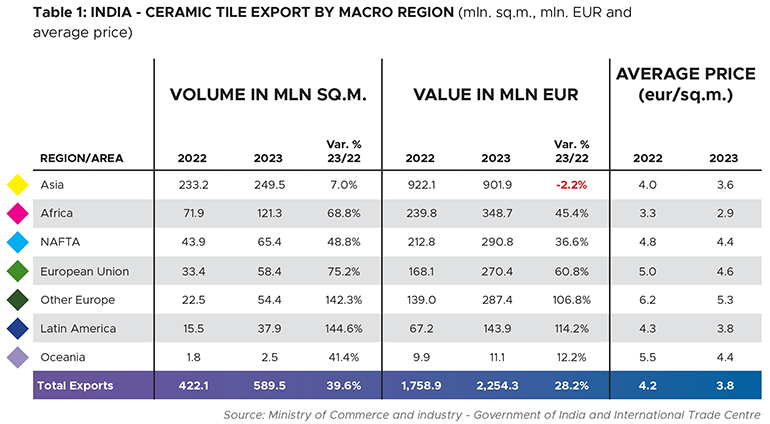

In 2023, India’s ceramic tile exports more than recovered from the decline recorded in 2022 (the only year of contraction in the history of the Indian ceramic industry, triggered by the energy crisis and the sharp increase in transport costs). Exports in volume reached 589.5 million sqm (+39.6% over 2022), while revenues rose to €2.25 billion (+28.2%).

Last year, Asian markets continued to account for the largest share of Indian exports (42.3% of total volumes), but it was outside Asia that India marked up the biggest increases. Africa was the second largest export region (+68.8% in volume and +45.5% in value), followed by North America and Mexico (65.4 million sqm) and the European Union (almost 60 million sqm, +75%). Exports to South America and non-EU Europe more than doubled.

India’s steady export growth in all global markets is even more evident when analysing the ten-year trend from 2014 to 2023.

While Indian exports overall grew at a compound average annual rate of 21.5% (CAGR 2014-2023), exports to Asia grew by +14.1%, compared to +93.5% to North America, +66% to non-EU Europe, +35.8% to the European Union, +25.7% to Africa and +22.4% to South America.

Year-on-year growth in value also proceeded steadily, with revenues rising from €325 million in 2014 to €2.25 billion in 2023 (CAGR 2014-2023: +24%). Here too, the biggest increase was in the NAFTA region (CAGR 2014-2023: +91.7%), the European Union and non-EU Europe.

Moreover, despite generating 40% of total revenues, in 2023 Asia was the only region to see a decline in exports in value compared to 2022 (-2.2%). Almost a quarter of export revenue was generated in Europe (EU + non-EU), while Africa and North America accounted for 15.5% and 13% respectively.

Average prices

In 2023, the average price of tiles exported from India stood at €3.8/sqm, declining in all target areas. However, there were marked differences between the various geographical areas of export, from €2.9/sqm in Africa to more than €4.5/sqm in North America and the European Union, and €5.3/sqm in non-EU European markets.

However, the MECS study reveals that average prices remained fairly stable between 2014 and 2021 (around €3.1-3.2/sqm), followed by a peak of €4.2/sqm in 2022 and another decline in 2023 to €3.8/sqm (-8.2%). North and South America was the only continent to record a decrease in the average selling price over the decade.

Almost all of the 139 target markets see growth

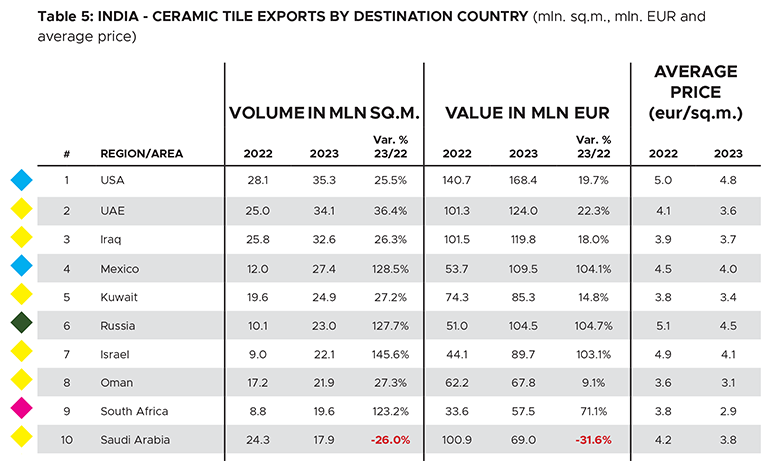

Out of a total of 139 countries to which India exported its ceramic tiles in 2023, only 21 showed a decline in export volumes. One of these was Saudi Arabia (-26%), which dropped from 4th to 10th place among India’s major export markets.

Overall, the ranking of the top destination countries for Indian tiles saw several changes in 2023 compared to the previous year. The top 10 continued to be led by the USA, while the United Arab Emirates climbed to second place, Iraq dropped to third, and Mexico gained fourth position thanks to a 128% increase in sales. Exports more than doubled in a single year to Russia (+127.7%), Israel (+145.6%) and South Africa (+123%), which now rank sixth, seventh and ninth respectively.

The highest average selling prices recorded by India in 2023 were for exports to Turkey (€8.5/sqm) and the UK (€7.6/sqm), while the lowest (€2.1/sqm) were for sales in several African countries.

→ For the complete list of 139 markets request the report

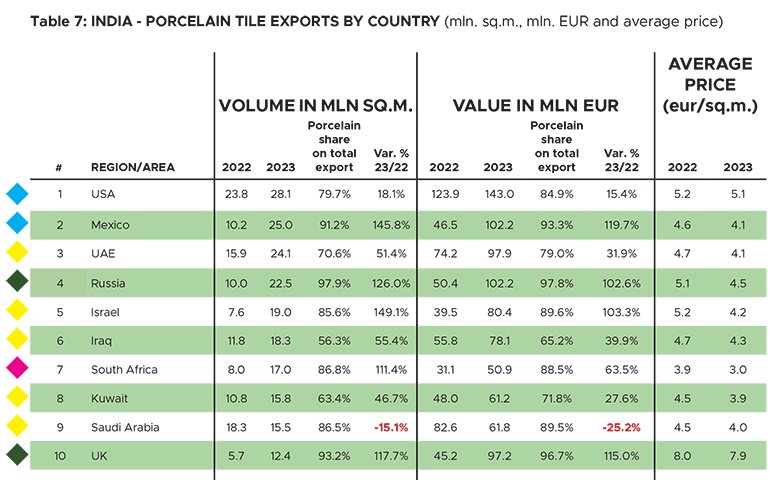

Porcelain tile exports

The MECS report also offers an interesting analysis of the types of tiles exported from India. It reveals that porcelain tiles accounted for almost 72% of India’s ceramic tile exports in 2023: a total of 423 million sqm, an increase of 48% from the 286 million sqm of 2022. Porcelain tile exports generated revenue of €1.82 billion, accounting for 80% of the Indian tile industry’s total export turnover and marking a 34.3% increase on 2022. The average price of this product type dropped to €4.3/sqm compared to €4.7/sqm in 2022.

The largest export markets for Indian porcelain tiles were the USA, Mexico, the United Arab Emirates, Russia and Israel with an average selling price of between €4 and €5/sqm, while the UK (the 10th largest export market) recorded an average price of €7.9/sqm.

Porcelain tiles made up more than 90% of imports from India in numerous markets, with peaks of 98% in Russia and almost 100% in Egypt.

→ For the complete list of 139 markets request the report

The top 30 Indian exporters

So who are the leading players behind the global growth of Indian tile exports? The MECS report provides a ranking of the top 30 exporters, mostly based in the Morbi ceramic cluster, in order of export-generated revenue over the two-year period 2022-2023.

The 2023 ranking is led by Icon Granito (€51 million export revenue), followed by Comet Granito, Lavish Granito, Sunshine Tiles Company and Itaca Ceramic, all with export revenues of between €43 million and €45 million. A glance at the list of the top three export markets for each player gives an interesting insight into the level of diversification of the main destination markets of the top 30 exporters, although Mexico, the USA and Russia are the markets that appear most frequently.

This is also confirmed by an analysis of the five top performing Indian companies for each of India’s ten largest foreign markets: USA, UAE, Iraq, Mexico, Russia, UK, Israel, Kuwait, Saudi Arabia and Oman. In general, the five top players are different in each market. There are very few exceptions to this, such as Icon Granite which ranks first in Mexico and Russia and second in the UK.

Finally, the MECS analysis indicates the degree of contestability of each market among Indian competitors themselves. It shows, for example, that in 2023 the least contestable market for other Indian exporters was Saudi Arabia, where the top five exporters accounted for 66% of India’s total exports by value. By contrast, the UK, the UAE and Oman were among the most accessible markets to multiple Indian exporters.

© All rights reserved

Did you find this article useful?

Join the CWW community to receive the most important news from the global ceramic industry every two weeks